Para referências, bibliografia, e demais conteúdos, acesse o livro completo em PDF.

2

ALLOCATIVE EFFICIENCY AND MEASUREMENT OF THE IMPACT OF THE SINGLE TAX

After more than fifteen years of controversy, the debate between those who defend and those who oppose the Single Tax model has produced important conclusions.

As we have shown throughout this text, some of the criticisms have turned out to be mistaken, and others were broadly refuted by facts. Among them are the fears of remonetization of the economy, of flight of depositors from the banking system, of the excessive verticalization of the productive process, of the impossibility of tax exonerations especially for exports, and of worsening the income distribution. At the same time, some of the positive features of bank transaction taxes, such as its imperviousness to tax evasion and its low operational and compliance costs have been widely acknowledged even by the tax’s earlier detractors.

Delfim Netto reflects on these conclusions in an article in which he evaluates the study conducted by the Federal Revenue in defense of the bank debit transactions tax (CPMF). Following a brief summary of what he called “the government’s fiscal/financial philosophy”, he expresses, “certain sympathy with this position, despite finding it nihilistic”. Yet, despite this concession, he immediately criticizes cumulative taxes such as the bank debit transactions tax (CPMF) on an issue which he considers to be the last one not yet properly rebutted by those who defend such taxes. “This discussion avoids the real question of defining what should be the role of fiscal policy in the process of economic development”, and continued, saying, “the productive efficiency of the market economy increases in direct proportion to the decrease in the distortions introduced into relative prices when compared to the free functioning of supply and demand. [...] it is known that cascading taxes introduce greater distortions than value-added taxes.”

Therefore, it is important to evaluate the impact of alternative tax models (cumulative versus VATs) on relative prices.

One of the most important issues in public finance is the normative evaluation of allocative and distributive effects of different systems of taxation. One specific point of interest has to do with comparing the changes in relative-prices introduced by value-added taxes (VAT) to those introduced by turnover taxes, such as the bank transactions tax.

Under highly restrictive conditions, a VAT introduces less relative-price changes than a cumulative tax. For this statement to be true, the following conditions must be met: (a) perfect competition; (b) absence of tax evasion; (c) universal tax base – that is, both taxes must apply to all goods and services transacted in the economy; and (d) a single and identical tax rate applied to both forms of taxation.

The four conditions listed above are very strong assumptions, and none of them is satisfied in the Brazilian economy. The absence of perfect competition is notorious. Large-scale VAT evasion is practiced in a broad variety of forms. Generally, taxation is applied to tax bases that are segmented by sector, activity, or by income categories. And almost all taxes in Brazil have multiple rates.

As such, it is impossible to state, a priori, which form of taxation, VAT or turnover, causes fewer distortions in price determination. With multiple rates, patterns of tax incidence virtually randomized by tax evasion, and sectoral income influenced by varying competitive conditions prevailing in each sector, a definitive statement one way or the other becomes all but impossible.

Thus, it becomes necessary to evaluate empirically the effects these two taxes have on price formation mechanisms.

THE CONSTRUCTION OF THE BRAZILIAN INPUT-OUTPUT TABLE FOR 2006

Input-output economics has proven to be a valuable instrument for investment and development planning. Nevertheless, it has seldom been used in simulating the impact of different tax models on prices.

In this text, an input-output model will be developed to analyze the effects of alternative tax models. The objective is to draw normative conclusions, in terms of equity and allocative efficiency. The simulations will compare value-added to cumulative taxes, such as a bank transactions tax, and will attempt to draw conclusions about their relative advantages and disadvantages in an effort to throw further light in the debate on tax reform in developing countries.

Physical input-output

The system of equations below describes a closed economy with no government, one factor of production (labor), and “n” productive sectors:

X1 = X11 + X12 + X13 + …+ X1n + D1

X2 = X21 + X22 + X23 + …+ X2n + D2

X3 = X31 + X32 + X33 + …+ X3n + D3

.

. (1)

.

Xn = Xn1 + Xn2 + Xn3 + …+ Xnn + Dn

L = L1 + L2 + L3 + ... + Ln

where

i, j = production sectors (1...n)

Xi = gross output of sector i,

Xij = amount of product i used as input by sector j Di = final demand for product i, L = labor inputs in sectors 1…n.

Let aij= Xij/Xj. They show the amount of input i necessary for the production of a unit of output j. Thus, Xij=aijXj, and Xi= aijXj+Di. Thus, in matrix notation, and defining

A= matrix of technical input-output coefficients, with typical elements given by aij= Xij/Xj

it becomes possible to conclude that

X = AX + D

D = (I-A) X

X = (I-A) -1 D (1a)

X = [cij] D

where (I-A) is called the matrix of Leontief Coefficients, and its inverse, (I-A)-1= [cij] is the matrix of direct and indirect requirements of input i for the production of a unit of output j. In order for a sector i to have a positive net production, it is necessary that Xi >Xii and Xi - aii Xi > 0. Thus, aii <1.

Model (1a) is widely used for output and investment planning, since it predicts the correct output combination necessary to produce a projected vector of final demand goods.

Value input-output

The basic physical relationships given by (1) have a dual representation in value terms, where sums of columns and rows are equal:

Y1 = Y11 + Y12 + Y13 + …+ Y1n + D1P1

Y2 = Y21 + Y22 + Y23 + …+ Y2n + D2P2

Y3 = Y31 + Y32 + Y33 + …+ Y3n + D3P3

.

. (2)

.

Yn = Yn1 + Yn2 + Yn3 + …+ Ynn + DnPn W = W1 + W2 + W3 + ... + Wn

Let Yij = Xij Pi , and Yj = Xj Pj. where

Yij = value of sales of sector i to sector j

Pi,j = price of product i, j

Wi = total wage bill paid by sector i.

The value of sales of sector i necessary to produce one unit value of output j is defined as

bij, = Yij/Yj = XijPi/XjPj = Piaij/Pj.

Total wage bill paid by sector j is given by Wj =PL Lj and wj = Wj/Yj = PLLj/PjXj = PLdj/Pj where

PL = price of labor

Lj = total labor input used by sector j dj = Lj/Xj = labor used in a unit production of output j (labor coefficient).

These relationships imply that

Yi = jYij +PiDi = jbijYj + PiDi

which in matrix notation can be expressed as

Y = BY +PD

PD = (I-B)Y (2a)

Y = (I-B)-1 PD

where

Y = value of gross output

B = matrix of input coefficients in value terms

P = vector of product prices

and (I-B)-1 = [I- (Piaij/Pj)]-1 represents the direct and indirect value of product j necessary for the production of a unit value of final demand i.

Model (2a) is also widely used for output and investment planning, and determines the value of production and investment targets, disaggregated by sectors, given a vector of final demand.

Price input-output

Since in value terms sums of rows and of equivalent columns are equal, a typical equation in the system is given by Yi = Yij + Wi . Thus, adding along columns of (2)

Y1 = Y11 + Y21 + Y31 +...+ Yn1 + W1 Y2 = Y12 + Y22 + Y32 +...+ Yn2 + W2 .

.

.

Yn = Y1n + Y2n + Y3n +...+ Ynn + Wn

Since Yi= XiPi and Wi= PLLi, and taking i=1 as a typical equation we get

X1P1 = X11P1 + X21P2 +...Xn1Pn + L1PL (3)

Dividing both sides by X1,

P1 = (X11/X1)P1 + (X21/X1)P2 +...+(Xn1/X1)Pn + L1PL/X1

and remembering that aij=Xij/Xj and that dj = Lj/Xj we get the basic economic identity in production and price formation, without taxation,

P1 = a11P1 + a21P2 +...+an1Pn + d1PL

P2 = a12P1 + a22P2 +...+an2Pn + d2PL

P3 = a13P1 + a23P2 +...+an3Pn + d3PL

.

. (4)

.

Pn = a1nP1 + a2nP2 +...+annPn + dnPL

In matrix notation,

P = A´ P + d PL

P = (I-A´)-1 d PL (5)

where

A´= transpose of A =[aij] d = [di] =vector of labor coefficients.

Model (5), which is a variant of model (2a), allows the simulation of the impact of factor prices (wages in this simple model) on product prices. This is the basic relationship that will be used to analyze the impact of different tax models on product prices.

THE SIMULATION MODEL AND THE STATISTICAL DATA BASE

According to model (5), simulations will require data on the technical inputoutput coefficients aij, as given by the intermediate consumption matrix A.

Brazilian National Accounts are reported in value terms. Thus, it is possible to derive the bij coefficients which express the value of sales of sector i necessary to produce one unit value of output j, as expressed in matrix B. This will be the basis of our simulation models, and the equivalence of matrices A and B for our purposes will be shown below as we need to normalize the price vector to be equal to unity.

In this section, the model to be used in our simulations will be constructed, considering the data availability as given by the official National Income Accounts.

Brazilian National Accounts Tables report the profit margins in each sector.

Thus, such information is incorporated in the model by making equation (3) equal to X1P1 = (X11P1 + X21P2 +...Xn1Pn + L1PL) (1+ m1)

where

m1 = mark-up coefficient on circulating capital.

Since aij=Xij/Xj and dj = Lj/Xj we get

P1 = (a11P1 + a21P2 +...+an1Pn + d1PL) (1 + m1)

P2 = (a12P1 + a22P2 +...+an2Pn + d2PL) (1 + m2)

P3 = (a13P1 + a23P2 +...+an3Pn + d3PL) (1 + m3)

. (6)

.

.

Pn = (a1nP1 + a2nP2 +...+annPn + dnPL) (1 + mn)

In matrix notation,

P = (F0 A´) P + F0d PL , and

P = (I – F0A´) -1 F0 d PL (7)

where

A´= transpose of A =[aij]

F0 = diagonal matrix of mark-up coefficients [1+mi] d = [di] =vector of labor coefficients.

Since, as seen before, aij = Xij/Xj and dj = Lj/Xj algebraic manipulation of a typical row ( such as i=1) of system of equations (6) results in

P1 = [(X11/X1)P1 + (X21/X1)P2 +...+(Xn1/X1)Pn + L1PL/X1] (1 + m1)

Multiplying both sides by (X1/ X1P1) yields

1 = [(P1X11)/ X1P1 + (P2X21)/ X1P1 +...(PnXn1)/X1P1 + + (PLL1)/ X1P1] (1 + m1)

Remembering that each element in the input-output table B is given by bij = (PiXij)/(PjXj), and that wj = (PL Lj)/(PjXj), by substitution we get the basic estimating data used in the simulations, whereby prices are normalised to be equal to one. Thus,

1 = (b11 + b21 + b31 + ...+ bn1 + w1) (1 + m1) 1 = (b12 + b22 + b32 + ...+ bn2 + w2) (1 + m2) 1 = (b13 + b23 + b33 + ...+ bn3 + w3) (1 + m3)

.

. (8)

.

1 = (b1n + b2n + b3n + ...+ bnn + wn) (1 + mn)

An input-output table for 2006 constructed in the format of equation (8) is used in simulating the economic impacts of different taxes. Note that since it is built in a way that forces Pi =1 for all i, and since we know that bij, = Piaij/Pj, then bij must be equal to aij.. Thus, model (8) is equivalent to model (6). In other words, in building our simulation models it is irrelevant which one is actually employed. Thus, in describing the dynamics of the structure of industrial price formation we chose model (6), which is more intuitive as far as price formation and tax simulations are concerned.

The construction of the input-output table

It is necessary to produce a matrix of input-output coefficients representing intermediate use of inputs in production. In terms of value, such information is contained in matrix B, as in model (8), or, in physical units, in its dual matrix A, as in model (6).

Brazilian National Accounts statistics, which follow the guidelines set up by the 1993 United Nations System of National Accounts (1993 SNA), allow the construction of the input-output matrix B for 2006, the latest available year up to the date of this publication.

The starting point for the construction of an input-output table is the Supply and Use tables (SUTs) which are part of the National Accounts Statistics, as published by the IBGE (Brazilian Institute of Geography and Statistics).

The Brazilian SUTs contain production and use (supply and demand) statistics for 110 products and 55 activities. The official Brazilian input-output table is made up of 55 activities. However, as the SUTs contain production information for 110 products, it is possible to construct a 110 entry input-output table organized in terms of products X products, instead of activities X activities. Doing so results in more disaggregated information, which is preferable as it allows more precise analysis of the impact of taxes on prices.

This was done as follows.

SUTs are products X activities matrices that have three parts:

1. The resources table, (also called the “make” table);

2. The intermediate uses table; and 3. The final uses (or final demand) table.

From the SUTs, and assuming that i=row, j= column, that a capital letter represents a matrix, and that a lowercase letter represents a column vector, the following tables can be derived:

where

V= matrix of value of production of each activity, by product, in basic prices;

U = matrix of total intermediate consumption (domestic and imported goods) of each product by activity, in market prices;

M= matrix of margins, taxes and imports, where columns represent respectively a trade margin vector (tm), a transport margin vector (trm), a vector of import taxes (mt), an IPI tax vector (ipi), an ICMS tax vector (icms), and a vector of other taxes net of subsidies (ot);

F = matrix of final demand by type of final demand, where columns represent respectively the vectors of final consumption by families, government consumption, exports, capital formation, and inventory changes; such final demand vectors will be referred to as (Fj), and are all expressed in market prices; m = vector of value of imported products q= vector of gross value of production for each product; and g= vector of gross value of production for each activity.

For illustrative purposes a reduced 12 sector National Account Table is reproduced in ANNEX I-C.

In order to produce an input-output table from the SUTs it is necessary to make important adjustments for two basic reasons: a) because prices in the table of intermediate consumption (U) are reported in market (or consumers´) prices, whereas we wish to have an input-output table in basic (or producers´) prices, and b) because the intermediate consumption table does not differentiate between domestic and imported products, whereas we wish to have an input-output table of domestic production.

The relationship between basic and market prices are given by

Basic Prices = Market Prices – Trade Margin – Transport Margin – (Taxes - Subsidies).

Thus, the first task is to take margins, taxes, and imports out of the values reported in the intermediate use table, and transform them from total intermediate use tables at market prices to intermediate use of domestic products at basic prices. In other words, it is necessary to find dt such that

Unbp = Ump - dt

where

Unbp = matrix of intermediate consumption of domestic goods of each product by activity, and dt = matrix that registers the sum of the value of margins, taxes and imports to be subtracted from the corresponding entry in the U matrix in order to turn it from a market price total intermediate use table at market prices into a basic price table of intermediate consumption of domestic products, by each activity, and bp = basic prices mp = market prices.

Since trade margins, transport margins, and taxes (which are columns of M), and the imports vector in the supply table of the SUT´s are column vectors by products, and therefore do not discriminate by activities, it becomes necessary to adopt a distribution criterion according to which total margins, taxes, and imports are distributed to the activities that produce such products. It should be noticed that even in the construction of a product X product input-output table the margins, taxes, and imports are first distributed among activities, and the resulting intermediate domestic consumption (now in market prices) by activities are allocated to the various production processes and to their secondary production. This two-stage procedure is necessary since the SUTs tables are reported in the product X activities format.

The transformation of market values into basic values, and of total intermediate consumption into domestic intermediate consumption, is obtained through the construction of two distribution matrices (P and P*) used to introduce a weighted average method of distribution of margins, taxes and imports among activities.

Let P be the distribution matrix with a typical cell that represents the value of the intermediate consumption of a product (elements from the U matrix) divided by the value of total demand for the same product, all at market prices as published by the IBGE. Since by construction of the SUTs

q = U.i + F

where

i = column vector where each element has value equal to unity,

it follows that

P = U . <q>-1

where

<a> is a diagonal matrix with elements given by vector a.

A typical element of P is

[uij/ j uij + j Fj]

showing the proportion of a product´s total demand used up as intermediate consumption in each of the activities that produce such a product.

Matrix P can be used to distribute the values of a column vector (such as total trade margin, or total transport margin) used up by the production of a good or service (a product) proportionally to the fraction of the product value which is produced by each activity.

Thus, the allocation of trade margins among the various activities is given by

Ptm = P´. <tm>

where

Ptm = matrix of products´ total trade margin distributed by activities that produce such product, and

P´= transpose of P

The transpose of matrix Ptm, expressed as

P´tm = ( P´.<tm> )´ (9)

has as each of its elements the portion of the of total trade margin to be subtracted from each respective entry in the U matrix.

Similar procedure is used to calculate the matrix

Ptrm = P´. <trm>

where

Ptrm = matrix of products´ total transport margin distributed by activities that produce such product.

Similarly, we can derive

P´trm = ( P´.<trm> )´ (10)

which has in each of its cells the portion of the of total transport margin to be subtracted from each respective entry in the U matrix.

Following the same procedures, the distribution matrix for the IPI tax (ipi) and for Other Taxes Minus Subsidies (ot) are given by

P´ipi = ( P´.<ipi> )´ (11)

P´ot = ( P´.<ot> )´ (12)

The need to construct two distribution matrices (P and P*) is due to the fact that it is necessary to subtract the value of exports (a column of the F matrix) from total final demand when computing the distribution coefficient for some vectors of the final demand, such as Import Taxes, and the ICMS tax. This becomes necessary since none of such taxes are levied on exports, and therefore the value of exports should not influence the weights on the distribution of such taxes, which are levied entirely on domestically consumed products.

Furthermore, since we wish to produce an input-output table for domestic production, it also becomes necessary to subtract the imported components from each element of the U matrix. Thus,

P*= U . <q*> -1

where

q*= U.i + (F-Fx)

and

Fx = vector of value of exports by product.

The “net of exports” distribution matrix P* is used to calculate the value of imports, import taxes and the value of the ICMS tax to be subtracted from each element of the U matrix, following similar procedures as those used with trade and transport margins, and with IPI and Other Taxes. Thus, the required adjustment for the ICMS (icms), for Imports (m) and for Import Taxes (mt) are given by

P*´icms = ( P*´.<icms> )´ (13)

P*´m = ( P*´.<m> )´ (14)

P*´mt = ( P*´.<mt> )´ (15)

Finally, to transform the U matrix from a market price table into a basic price table, and also from a total intermediate use table into a domestic intermediate use table (and remembering that Unbp = Ump – dt ) it suffices to subtract each of the distributed margins, taxes, and imports from each cell in the U matrix, thus transforming it from a market price, total intermediate use table (Ump) into a basic price table of intermediate consumption of domestic products by activities (Unbp).

Thus, the matrix dt is the the sum of the matrices given by equations (9), (10),

(11), (12), (13), (14) and (15) where each equation gives the value of the margins, taxes, and imports that should be subtracted from the respective entry in the U matrix in order to turn it from a market price (Ump) into a basic price table (Unbp).

The resulting Un matrix, at basic prices, is the fundamental component in the development of the input-output models used hereafter.

But before the basic input-output model is constructed a second methodological question must be tackled.

The published official SUTs (more specifically the U matrix from which we derived the Un matrix) are rectangular matrices containing 110 products and 55 activities. The IBGE also publishes a square input-output table with 55 entries by activities. However, as seen before, it is possible to construct a 110 entry inputoutput table organized in terms of products X products, instead of activities X activities.

To do so, we start with a few basic questions and relations.

One question is how to transfer demand for 110 products to the 55 activities; alternatively, how to distribute the output of 55 activities into the 110 production processes.

The second question is how to allocate the intermediate consumption of inputs to the 55 activities; or alternatively to the 110 production processes.

The methodology to deal with the first question implies the construction of a Market Share Matrix D as follows:

D = V . <q>-1

and

V = D . <q> (16)

The market share matrix D will be used to distribute demand from products to activities.

To answer the second question, and to allocate the intermediate demand for domestic products to activities, we assume that inputs are proportional to value of production according to the Matrix of Domestic Technical Input-Output Coefficients at basic prices Bn given by

Bn = Unbp . <g>-1 (17)

from where it follows that

Bn . <g> = Unbp (18)

showing that each intermediate use of a product by an activity is divided by total value of production for that same activity.

Finally, observing the Use Table of the SUTs , it can be seen that the vector representing the value of production by product is given, from the demand or use side, by

q = Unbp . i + Fn (19)

with a typical element in basic prices given by [qi = j unij + Fni], or alternatively, from the supply or resource side of the SUTs,

q = V´. i

where V´is the transpose of V, and with a typical element given by

[qi = j v´ji].

Also, the value of production by activity is given by

g = V.i (20)

with a typical element equal to [gj = i vij].

Total value of production, the sum of columns or of rows, is given by

i qi = j gj .

Substituting equation (18) into equation (19) and eliminating Unbp yields

q = Bn <g>. i + Fn

q = Bn . g + Fn (21)

Next, multiplying both sides of equation (16) by the column vector i , remembering equation (20), and since <q>.i = q

g = D.q (22)

and substituting (22) into (21) yields

q = Bn . D . q + Fn q – Bn. D. q = Fn q (I-Bn.D)-1= Fn

q = (I-Bn.D)-1 Fn (23)

Equation (23) is the basic product X product input-output model used in the simulations that follow.

It is worth noticing that the activity X activity input-output model could be easily obtained by substituting (21) into (22), yielding

g = D.(Bn.g +Fn) g – D.Bn.g = D.Fn g.(I-D.Bn) = D.Fn

g = (I-D.Bn)-1 D.Fn (24)

Equations (23) and (24) are therefore the two possible representations of the input-output model given the SUTs tables reported for the Brazilian economy, and both are strictly compatible with equation (2a) above, which defines conceptually the input-output model as created by Wassily Leontief. Pre-multiplying the Bn matrix by D (D.Bn) yields the matrix of technical coefficients activity X activity; postmultiplying the Bn matrix by D (Bn.D) yields the matrix of technical coefficients product X product; D.Fn yields final demand vector by activity; and Fn is the final demand vector by product.

After constructing matrix Bn.D, which is what interests us in our simulations, and remembering that prices of all products were constrained to be equal to unity, the matrix of technical coefficients Bn.D is complemented with the following rows: a Sum row, with sums of technical coefficients by column, an Imports row containing the sum by column of the technical coefficients of imported intermediate products, a Wages row, containing coefficients given by the division of the “wages paid” by the “gross value of production” both contained in the value-added part of the Use Table of the SUTs , and finally a residual Gross Profit Margin row, by activity.

Of course, summing the column of intermediate use and adding the value-added components of the production process amounts to unity.

Simulation models

The SIM (0) model

We now construct our simulation models, which will incorporate the basic conceptual input-output model given by (6) together with the empirical matrix of domestic technical input-output coefficients at basic prices (BnD) contained in equation (23).

Equation (6) incorporates information on profit margins through the use of mark-up coefficients applied on circulating capital. We adopt the hypothesis that advances on purchase of inputs and on payment of wages have to wait for a certain production period before it is recovered through sales to other sectors and to final demand. During this period the firms earn a “waiting fee” of mi % of the circulating capital used in purchasing inputs and in paying wages. Such mark-up margin may also include a competitive profit margin, or normal profits. This model is certainly more realistic than the zero-profit assumption implied by (4). Thus, remembering that equation (6) is equivalent to equation (8) (since, as seen before, aij = bij) a typical price accounting equation is given by

Pi = [ j(bijPj) + wi ] (1 + mi )

where

Pi,j = price of product i, j , (1...n) bij = value of input j per unit value of product i wi = value of labor input per unit value of product i mi = mark-up on circulating capital of product i.

In matrix notation the model described above can be expressed as

P=[ F*K ] P + F*w

P- [F*K] P = F*w

[I – F*K] P = F*w

P= [I – F*K]-1 F*w SIM (0)

where

P =vector of final prices (n x 1)

I = identity matrix (n x n)

F* = diagonal matrix [(1 + mi)] (n x n)

K = the transpose of matrix B of technical coefficients bij (n x n) w = vector of wi , value of labor input per unit value of product i (n x 1).

This model, called SIM (0) is the benchmark with which all other simulations will be compared. It represents an economy without taxation, and in which all prices are normalised to equal unity. Note that, in terms of the statistical data available, matrix K above is the exact equivalent to the transpose of matrix (Bn.D) in equation (23). Thus, for strictly denominational purposes K= (BnD)´ in this and in all other variants of the simulation models, as described below.

The introduction of taxation will result in a different set of prices which, compared to unit prices implied by the SIM (0) model, will describe their percentage change resulting from the choice of taxes used by the government. Different taxes will be introduced, and the resulting prices will be compared to those given by the benchmark model (SIM 0) with no taxation.

The SIM (1) model:

This model introduces the bank transactions tax. It is charged on both debit and credit entries on clients´ bank accounts. It has a double incidence on each transaction, shared by purchaser and seller. As an example, suppose that the bank transaction tax with a 1% rate is applied on a $100 purchase of an input for production of a certain output. The purchaser’s bank account will be charged $101, and the sellers bank account will be credited $99. Thus, a $100 transaction will result in tax revenue of $2, shared between the two agents involved in the transaction.

For each economic agent such as a producer, the cost accounting records will register a 1% tax cost on all outlays on inputs and on labor, and also another 1% tax on sales of final products. This can be expressed in terms of prices as

Pi = (1+t) {(1+t)[ j(bijPj) + wi ] (1 + mi )}

where

t = the bank transaction tax rate.

In matrix notation,

P = F[KP + w]

P = [FK]P + Fw

P = [I – FK]-1[Fw] SIM (1)

where

F = diagonal matrix [(1+t)2 (1+mi)]

The SIM (1) model estimates the effect on sector prices of a bank transactions tax. The matrix F, is the product of two diagonal matrices: the first [(1+t)2] , represents the effect of the uniform rate of the bank transaction tax, and the second, [1+mi] reflects the impacts of the sector mark-up coefficients. Matrix F introduces the turnover effect into the system, iterating with the mark-up coefficients.

The SIM (1) model implies that no other tax is imposed, and therefore it isolates the effect of the bank transactions tax on prices. If compared to the hypothetical “no tax” situation implied by the SIM (0) model, the total cumulative effect of a bank transactions tax on sector prices can be effectively evaluated.

The SIM (2) model:

This model introduces a value-added tax into the initial no-tax system SIM (0). As usual, tax payments included in the price of purchased inputs will be deducted from tax liabilities due by the seller of the final product. It is assumed that the final price for each sector comprises the VAT cost according to the following relation:

Pi = [total outlays plus profit margin]/(1-v)

where

v = uniform VAT rate.

Thus, the pricing model can be expressed as

Pi = (1/(1-v)){ [( j(bijPj) + wi ) (1 +mi)] - v j(bijPj)}

or,

Pi = [((1+mi–v)/(1-v)) j bijPj] + ((1 +mi)/(1-v)) wi

In matrix notation the model can be expressed as

P = [F1K]P + F2w

P = (I - F1K)-1 F2w SIM (2)

where

F1 = diagonal matrix [(1+mi-v)/(1-v)]

F2 = diagonal matrix [(1+mi)/(1-v)]

Defining M as the mark-up diagonal matrix with elements [1+mi], A as the VAT diagonal matrix with elements [1/(1-v)], and C as the value-added credit diagonal matrix with elements [-v/(1-v)] it can be seen that F2 = MA and F1 = F2 + C.

It is important to note that in this model the mark-up rate is levied on input prices with the VAT tax included, in the same way as with any other cost of production. Thus, it is assumed that VAT taxes included in input prices are paid as an advance to the government, and that there is a waiting time equivalent to an average production period before the tax advance is paid back to the producer in the form of a credit against his VAT tax liabilities due when final product is sold.

This hypothesis implies that the VAT incidence on final prices is not uniform and cumulative, as opposed by standard theoretical analysis of the incidence of value-added taxation on final prices. VAT´s may have differential impacts on prices of different products, thereby distorting relative prices of intermediate goods in a way that is formally quite similar to cumulative taxes.

It becomes clear, therefore, that the alleged neutrality of the VAT can only be guaranteed in the unlikely situation where all mi= 0, in addition to the seldom seen application of a single VAT tax rate for all products and services traded.

Thus, the assumption that VATs have a neutral impact on relative prices is not warranted, and proves erroneous the assumption that they are less distortionary than turnover taxes as far as their effects on prices are concerned.

The SIM (2´) model:

In a mark-up model, a VAT will show the neutrality properties usually assumed in simplified textbook models, only if it meets an exceedingly strong assumption: that value-added tax credits are instantaneous. In other words, the pricing model becomes

Pi = (1/(1-v)){ [( j(bijPj) + wi ) - v j(bijPj) ] (1 +mi) }

Pi = (1/(1-v)){ [ (1-v) j(bijPj) + wi ] (1 +mi) }

and

Pi = (1 +mi) j(bijPj) + (1+mi)/(1-v) wi

In matrix notation,

P = MKP + F2w

P = (I-MK)-1 F2w SIM(2´)

where

M= the mark-up diagonal matrix with elements [1+mi]

F2 = diagonal matrix [(1+mi)/(1-v)]

It should be pointed out that in this model the prices of intermediate inputs are multiplied by matrix M, composed solely of the mark-up coefficients. Thus, the value-added tax will not influence prices through their effect on prices of intermediate inputs, as happened in model SIM (2) when intermediate prices were multiplied by the F1 matrix, which includes both the mark-up coefficients mi and the value-added tax rate v.

Furthermore, it should be noted that even if mark-up rates equal zero in all sectors, the expected “neutrality” of value-added taxes (defined loosely here as a proportional increase in all prices of intermediate inputs), will only occur if there is a uniform VAT rate applied to all sectors. The multiplicity of value-added tax rates, as is the case in practical applications of such taxes throughout the world, does not guarantee its neutrality, as commonly claimed, even in the (unlikely) case of zero mark-up rates.

On the other hand, the labor cost, which by definition is the same as the valueadded in production, is amplified by the mark-up margin and by the VAT rate v, present in the F2 matrix. The incidence of the VAT on the labor component in production does not allow for credits, since its total incidence falls completely on final prices, as expected by conventional value-added tax theory. Thus, its effects are similar to a tax on final sales, guaranteeing neutrality in intermediate prices, and therefore on production costs. Nevertheless, the assumptions of such model are extremely unrealistic, restricting severely the usefulness of its policy prescriptions.

SIM(2)EXT: extensions of the SIM(2) model

Given the exceedingly strong assumptions implied by the SIM (2´) model, the original SIM (2) structure will be used for comparing alternative tax systems.

Such construct can easily incorporate other taxes in its analytical framework.

Three other important taxes in current use in Brazil can be easily included into that same input-output framework, namely a turnover tax on services, the ISS, a value-added tax on industrial products (IPI, similar to a value-added excise) and the payroll social contribution to the INSS, the federal social security agency.

The incidence of the ISS is upon the value of both intermediate and final gross sales of services. It has an identical impact on prices as the mark-up rate, and thus it suffices to add the sectoral ISS rates to each corresponding mark-up rate, simply adding each si (the ISS rate applicable to sector i ) to each mi. Identical procedure, mutatis mutantis, should be used to introduce the IPI in the model, adding its rate pi to the sectoral VAT rate vi.

As far as the INSS is concerned, its impact on prices is equivalent to an additional labor cost corresponding to the INSS uniform rate µ. Thus, it suffices to replace each wi for w´i, where w´í = (1+µ). Therefore, the simulation model used to represent the conventional Brazilian tax model made up of two value-added taxes, a turnover services tax, and a single social contribution rate on wages can be represented as

Pi = (1/(1-vi´)){ [( j(bijPj) + w´i ) (1 +mi +si)] -

- vi´ j(bijPj)}

where

si= the ISS rate for sector i vi´= v + pi pi = the IPI rate for sector i

w´í = wi(1+µ) µ = the social security rate on wages.

As a result, in the extended SIM(2)EXT model

F1 = diagonal matrix [(1+mi+si –vi´)/(1-vi´)] F2 = diagonal matrix [(1+mi+si)/(1-vi´)] w´ = vector of w´i , value of labor units per unit of product i , including social

contributions.

The simulations contained in this text, therefore, will use the SIM(0) model as the benchmark for a “no tax” situation, which theoretically represents the least distortionary situation, and against which the effects of alternative taxation systems will be compared. The effects of the bank transactions tax on prices will be measured by comparing SIM(1) results against SIM(0). And the SIM(2) model, and its extensions as in the SIM(2)EXT model, will be used to evaluate the current tax system applied in Brazil, as compared with the least distortionary situation implied by model SIM(0).

Evidently, the comparison of both the SIM (1) and the SIM (2) models with the benchmark SIM(0) model, will imply a corresponding comparison of models SIM(1) and SIM(2), as far as their impact on prices are concerned. Thus, the debate between the supporters of a VAT tax and those in favor of a bank transactions’ tax will finally occur with a quantitative perspective in sight, as opposed to the predominantly loose and fragile conceptual framework in which it has been occurring in the last two decades.

SETTING RATES FOR THE SINGLE TAX

The electronic tax on bank transactions was introduced in Brazil in 1993 through the enactment of Article 2 of Constitutional Amendment 3, which authorized a Complementary Law to create a Provisional Tax on Financial Transactions (IPMF). It should be effective until December 31, 1994, with a rate of 0.25% (a quarter of 1%) levied on the value of all current account bank debt entries.

The use of the IPMF, which began to be collected in August 26, 1993, was suspended by a Judiciary order on September 15, 1993 (Adin 939-7/DF). It became effective again on January 1, 1994, and was in force until December 31 of the same year, collecting R$ 3.7 billion, which amounted to 5.17% of total federal revenue, and 1.06% of Brazilian GNP.

Constitutional Amendment 12/96 reintroduced the financial transactions tax under the name of Provisional Contribution on Financial Transactions (CPMF), with a rate of 0.20%. Law 9311/96 authorized its use from January 23, 1997 until February 23, 1998.

From this period onwards a series of time extensions of the CPMF were enacted. The rate was changed in certain short periods, but it remained at 0.38% from 2001 until its extinction in December 31, 2007. The rates of the CPMF were the following:

• 0.20% between January 23, 1997 and January 22, 1999;

• 0.38% between June 17, 1999 and June 16, 2000;

• 0.30% between June17, 2000 and March 17, 2001; and

• 0.38% between March 18, 2001 and December 31, 2007.

TABLE 6 below shows the IPMF/CPMF revenue between 1994 and 2008. Revenue collected in 1995/1996 and 2008, when the financial transactions tax was not in effect, is attributed to residual revenue from taxable transactions which occurred in 1994 and 2007 respectively.

TABLE 6

In the six years during which the full rate of 0.38% was applied, the financial transactions tax collected on average 1.37% of GNP, or 6% of total federal revenue.

Its tax base amounted to 3.6 times the Brazilian GNP.

The Brazilian Tax Burden (2007/2008)

Even without the CPMF, total tax burden in 2008 was 1.15 percentage point above that of the year before, maintaining the upward trend initiated in the early 1990’s. Between 1995 and 2008 total tax burden, including federal, state, and municipal revenues, grew 7.5 percentage points, going from 28.4% to 35.9% of GNP.

To compensate for the projected loss of revenue in 2008 resulting from the cancellation of the CPMF, the rate of the pre-existing tax on loans and credit (IOF) was raised by 0.38%, and that of the Social Contribution on Net Profits (CSLL) of the financial sector was raised from 9% to 15%. Such measures resulted in additional revenue of R$ 23.6 billion in 2008.

TABLE 7 below shows federal and social security revenues for 2007 and 2008, as well as state and municipal fiscal revenues.

TABLE 7

In addition to the effects of higher tax rates on the IOF and on the CSLL for the financial sector, revenue from these taxes increased significantly due to higher volumes of credit transactions and also to higher corporate profits. In 2008, the IOF collected a larger share of GNP than in the previous year (+ 0.4 percentage point), while the CSLL showed a growth of 0.25 percentage point.

Other federal taxes that showed significant revenue growth were the corporate income tax, the withheld income tax on labor income, the international trade tax, and the industrial tax on imports (IPI). Such performance was due to larger corporate profits, to growth in formal employment, and to larger value of imports.

Social Security taxes showed a slight decrease due to the discontinuation of the CPMF, although the loss of revenue was almost completely compensated by the larger revenue raised by the Cofins, the CSLL, and by other social security contributions.

The satisfactory performance of the Brazilian economy in recent years also contributed to the larger state and municipal revenues, such as the ICMS, the ISS and the IPVA.

Single Tax: Estimating the Required Rate

In 2002 the Brazilian tax burden reached 31.86% of GNP. The rate of the Single Tax on Financial Transactions necessary to raise the equivalent revenue was estimated at 5.3%, equally split between the value of banks’ debits and credits.

According to a paper issued by the Federal Revenue Agency named “Brazilian Tax Burden- 2007”, the tax burden in 2007 reached 34.79% of GNP. Together with information issued by another of its various papers called “Analysis of Federal Revenue” published in 2008, and also with data from the “2007 Social Security Statistical Yearbook” we estimate that the rate necessary for the Single Tax to replace in 2007 the same revenue raised in 2002 would be 5.62%. While the tax burden increased 2.93 percentage points during those five years, the Single Tax rate would have to increase by 0.32 percentage point. Thus, for each percentage point increase in the tax burden, the single tax rate would have to be raised by 0.11 percentage point.

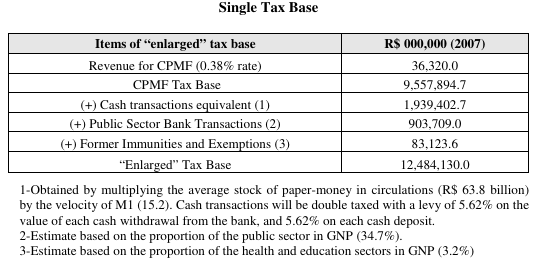

The estimates for the Single Tax rate necessary to replace the revenue raised by all predominantly fiscal taxes are shown in TABLE 8 below, and were based on the performance on the CPMF in 2007, the last year it was collected. We estimated an “enlarged” tax base, which in addition to the conventional CPMF tax base, includes the double taxation of the bank cash withdrawals and deposits, and the Single Tax levying on bank transactions done by the government and by privileged sectors and institutions, constitutionally exempt from the CPMF until 2007.

TABLE 8 below shows the “enlarged” tax base for the Single Tax. The starting point for the estimates is the tax base of R$ 9.6 billion for the CPMF in 2007.

TABLE 8

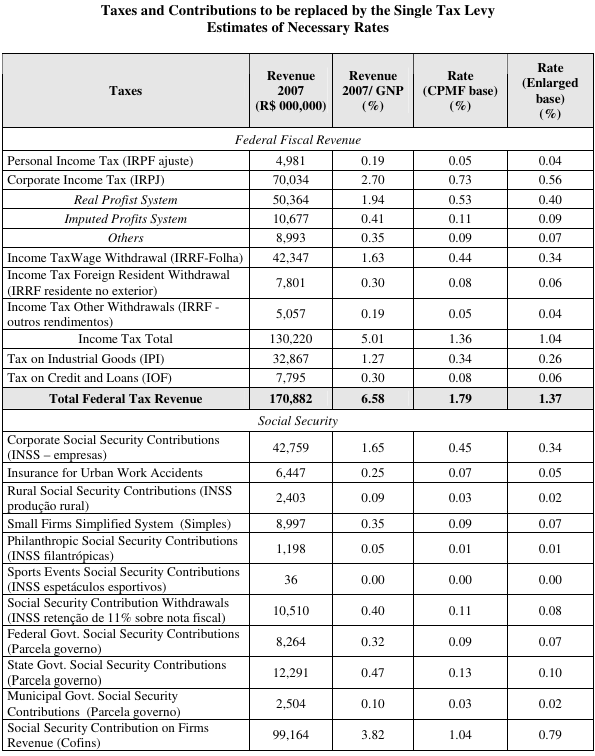

Total tax revenues to be replaced by the Single Tax collection amounted to 27% of GNP in 2007. Considering the CPMF tax base, federal taxes and contributions amounted to 17.9% of GNP, state revenues to 7.83%, and municipal taxes to another 1.27% of GNP, as can be seen in TABLE 9 below.

To replace all federal fiscal revenue the Single Tax rate would have to be 1.79% according to the CPMF base, and 1.37% according to the enlarged base. Including social security and economic contributions the rates would be respectively 4.87% and 3.72%. Adding the three state taxes and the three municipal taxes, the rate would have to be 7.34% according to the CPMF base, and 5.62% using the enlarged base.

In the Single Tax model, all corporate social contributions to the INSS, to the various quasi-governmental agencies (Sistema “S”), and to the educational fund (FNDE) would be discontinued. Of the approximately 35% of payrolls paid out by firms for social security contributions, only 8% for the Workers Unmotivated Dismissal Compensation Fund (FGTS) would remain.

It should be pointed out that the revenues of the “S”system would continue to be transferred to its administrators. The only change would be the way such revenue is raised. Instead of burdening firms’ payrolls with rates varying from 0.3% to 2.5%, as happened in 2007, it would be raised by the specific rate of 0.05% on bank transactions, which compose the estimated total Single Tax rate of 5.62%. The same would happen to the Education Fund (salário-educação), which instead of being financed by a 2.5% levy on payrolls, would be maintained by a specific rate of 0.06% on bank transactions.

The Single Tax system would imply a significant decrease in the tax load of the productive sector as a result of abolishing taxes on corporate income, on gross revenues, on sales and on profits. Furthermore, administrative costs would be significantly reduced as the costly declaratory taxes would no longer be collected.

Individuals would benefit from an increase in purchasing power as a result of lower indirect taxes on prices, and from a dramatic reduction in individual taxes on wages and on property.

TABLE 9

When the IPMF was introduced in 1993, following the polemical proposal in 1990 for the creation of a Single Tax on Financial Transactions, certain technical requirements for the proper use of a bank transactions tax were ignored by the government. Among them is the inadequacy of its application on transactions in the financial and capital markets. Taxation should not occur as the value of the principal in a capital or financial transaction is registered as credit or debit in a bank account. Taxation should occur only as the flow of real returns of such financial transactions goes through the banking system. Such characteristic of the bank transaction tax was thoroughly discussed elsewhere in this text.

In October 2004 the “investment current account”, linked to its respective bank “current account”counterpart, was created by the Brazilian Central Bank to redress this technical imperfection. The intention was to avoid taxing the value of the stock of financial capital as it flows within the banking system. Taxation of bank debits and deposits would occur only once as the value of the financial investment was transferred to the “investment account”, from where it could circulate, free of taxation, to and from other “investment accounts” to carry out typical financial dealings, such as purchasing and selling of bills, stocks, or any other financial asset.

It was a significant improvement, although in the pure Single Tax model the first transfer of investment funds, as well as all the other subsequent transfers, would be free of taxation as long as it remained within the realm of “investment accounts”. In fact, taxation of transactions in the financial and capital markets would remain very similar to the current income tax on financial returns.

TABLE 10 below shows the income tax revenue on financial profits in 2007, amounting to 1.15% of GNP.

TABLE 10

In the Single Tax model various existing taxes would remain in place, as they are considered to have preponderantly non-fiscal characteristics and are used mainly as instruments in public policy. Such is the case, for instance with the international trade taxes, which are instruments of industrial policy; the rural land tax (ITR), an instrument of land reform policy; and service fees, which are retributions to services rendered to individuals, devoid of the essential characteristics of public goods.

Other levies which would continue to be charged are those that may be considered as negotiated gains for workers, such as compulsory savings or compensatory payments in their favor, such as the Social Integration Fund (PIS), the Compensatory Fund for Unmotivated Dismissals (FGTS), and the own social security contributions of employees.

TABLE 11 below lists taxes, contributions, tax debt payments, fines and compulsory savings collected in 2007 and that would continue to exist even if the Single Tax Model were fully applied.

TABLE 11

SIMULATION RESULTS

The effect of types of different types of taxes on relative-prices can be evaluated using inter-industrial relations (input-output) models described above. We intend to compare the price effects of the Bank Transactions Single-Tax model to those of a VAT using Brazil’s inter-industrial structure drawn from technical coefficients of production contained in a 110 sector input-output table for 2006, constructed from data published by the IBGE [Brazilian Institute of Geography and Statistics].

Model SIM(1), described above, simulates sector prices by applying a singlerate turnover transactions tax, as estimated in the section above. In this model, all sectors have an infinite number of links in their production chains (which contradicts the general belief in the existence of “shorter” or “longer” production chains). The effect of a turnover tax on prices is inversely related to the proportion of value-added relative to the value of inputs from other sectors in each link of the production process. Clearly, the tax effect on final prices resulting from the use of such taxes is as smaller as the greater is the distance that separates a certain production process from the final step where it reaches the final consumer. In the simulations, we use a “mark-up model” to determine profit margins, as found by IBGE’s input-output matrix.

In the simulations, Model SIM(1) was used to evaluate the effect on final prices of the bank transaction tax as the single tax [Single Transaction Tax].

Model SIM(2) was used to evaluate the effect of the pure VAT. To define profit margins, we chose a variation of the “mark-up model” which seems more realistic in the sense of applying the mark-up multiplier to circulating capital as well as to cost of inputs. It is worth stating that no financial costs were imputed to the time spent “waiting” for the use of the tax credits, thus reducing the impact of a VAT on final prices.

It is important to note that we chose not to use Model SIM(2’) as the basis for our simulations, although it is the model that incorporates the conventional assumptions incorporated in the orthodox framework of value-added tax doctrine. The reason, as stated above, is the absurdly unrealistic assumptions that they assume, particularly with respect to developing countries such as Brazil.

Finally, in order to incorporate into the simulation models the other taxes composing the Brazilian tax structure (INSS, IPI, and the ISS) the SIM(2)EXT model was used, as shown above.

In the earliest papers on the Single Tax we sought to evaluate the impact of cumulative taxes on price formation in the economy. Simulations using the IBGE input-output matrices of inter-industrial flows and their updates led to the conclusion that because bank transaction taxes require nominal tax rates that are significantly lower than VAT rates for a given revenue target, and since they, consequently, discourage tax evasion, the bank transaction tax would have less of an impact on relative prices taking an ideal tax-free market equilibrium as a benchmark.

The statistical data and the assumptions implied in the construction of the inputoutput model used in the simulations are summarized in ANNEX I.

Cumulativeness, or the cascading effect, has caused critics to erroneously believe that more roundabout methods of production could drive tax costs upward. Simulations proved that those assertions were mistaken. For example, studies on the

Alternative Proposal demonstrated that the effect of a 2.7% rate bank transaction tax on sector prices ranged from 4.1% to 11.1% price hikes. Greater impact on production costs would be caused by a VAT, such as the ICMS, with 17% rate, bringing the tax burden to between 18.4% and 31.4% of the final price of products. Other studies that have been mentioned earlier used the same methodology and arrived at similar conclusions.

But, despite the absolute impact of a bank transaction tax on prices being weaker than those caused by VATs (assuming a given a revenue target), there remains doubt about the impact on relative prices, as Delfim Netto suspects.

Before trying to measure the impacts of different tax systems on relative prices,

it is worth noticing that there are theoretical reasons to believe that bank transaction taxes will be less distortionary than value-added taxes.

Yitzhaki has suggested that “in the extreme case where all commodities are taxed, they can all be taxed at the same rate, so that relative prices do not change and we end up with a zero deadweight loss.” Thus, a tax system with lower rates, and more widespread universal incidence across all commodities should imply a smaller impact on relative prices, and therefore, have smaller substitution effects and cause less allocative distortions on the economy.

There are two reasons for expecting that bank transaction taxes conform more closely to these requirements of absolute generality stated by Yitzhaki. First, bank transaction taxes have a single uniform rate, universally applied to all commodities. VATs, on the other hand, usually have multiple rates. Second, rates of bank transaction taxes are lower than those required from VATs to achieve a given revenue target: the tax base is broader, and evasion potential is more limited. Thus, it is expected that bank transaction taxes imply lower and more homogeneous tax burdens on commodity prices than VATs, thus being closer to a situation of relative price neutrality, as stated by Yitzhaki.

The simulations results described below confirm these effects.

No doubt, all taxes distort relative prices. However, it is believed that the cumulative effect of a bank transactions tax would cause even more intense distortions. It is believed that the VATs would be less distortionary because the tax burden on final prices could theoretically be determined entirely by economic policymakers and tax legislators as they set nominal tax rates.

The conclusion about the superiority of VATs in commodity production, as against cumulative taxes, would be partially true if two conditions were met: first, absence of tax evasion, and second, the existence of uniform rates for all sectors and products. Given that neither of these conditions is satisfied in real life, the conclusion that VATs necessarily introduce fewer distortions than a bank transactions tax cannot be reached a priori.

The efficiency advantages of VAT´s are highly questionable. The use of multiple rates, proliferation of exemptions, administrative and operational costs, sub national competence to apply value-added taxation and many other empirical shortcomings in the application of the VAT make its practical results fall significantly short of what is expected from its theoretical conclusions. Such problems are especially serious when the VAT is under sub national administration in federative countries

Furthermore, impacts on relative prices are not a result of the type of tax alone, but also of the intensity of the tax’s use, or of the value of its respective rates. Given that, for a specific amount of revenue, the bank transactions tax require rates that are significantly lower than what VATs require, we can immediately notice the fragility of assertions that cumulative taxes must necessarily introduce stronger distortions in relative prices.

The use of multiple rates and the existence of significantly more tax evasion in VATs make its impacts on relative prices be just as uncontrollable, random, and unintentional as they can be for bank transactions taxes.

It is possible that VAT-driven distortions could be even stronger than those generated by a bank transactions tax, given that tax evasion is a highly volatile, mutable, unpredictable, and camouflaged practice. In bank transactions taxes the variability of impacts on sector production costs over time are the result of changes in the production functions, which only occur over the medium and long terms. This means that bank transactions taxes, even with unintentional and uncontrollable patterns of incidence due to its cumulative effect, seem to be more stable than VATs. Tax evasion is generally most unstable even in the very short run, making the allocative effects of VATs a random event, with effects on relative prices even more unpredictable than those caused by a bank transactions tax. The simulations below will attempt to show that:

1. Even assuming away the existing differences in potential tax evasion, a bank transactions tax introduces less allocative distortions than VATs because it requires lower nominal tax rates for a given revenue target;

2. With the possibility of tax evasion being greater for VATs, the effect of these taxes on price becomes strongly distortionary, far exceeding the distortions in relative prices caused by bank transactions taxes.

This is an exercise in comparative statics, in which the tax models of the cumulative bank transaction tax and the non-cumulative VAT will both be compared to a heuristic situation of absence of taxation, which supposedly would be the optimal competitive equilibrium. Therefore, the farther the sector prices cum taxes distance themselves from prices that are free of taxes (which in the model below were set to equal to one, to unit), the greater the distortionary effect that they may have caused on prices, and therefore on tax burden.

The assumptions implied in each of the simulations are detailed in ANNEX I-A. Next, for each simulated situation, a matrix of relative prices shall be constructed (each element being a relative price for a pair of sectors), and the distance of each relative price from the unit value will measure the distortion caused by the respective tax model on the relative prices of that specific pair of sectors. The extent of overall distortion is given by the standard deviation of relative prices of the matrix, relative to the unit relative prices.

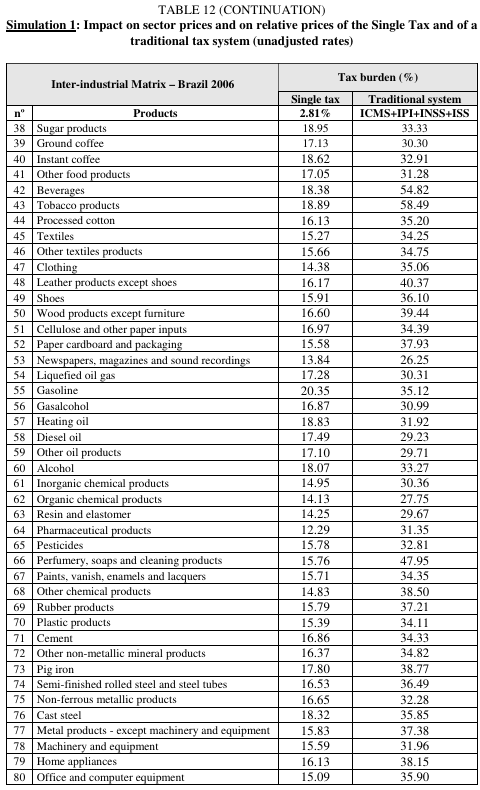

Simulation 1 in TABLE 12 compares the impact a bank transaction tax as a Single Tax would have on relative prices, compared to a conventional tax model. The simulation only includes indirect taxes, and does not include the foregone revenue raised by taxes on property (IPTU, IPVA, ITR, etc.), on personal and corporate income (IRPJ, IRPF), on foreign trade, and on other taxes that have extrafiscal or regulatory characteristics. Therefore, the simulation is strongly biased against cumulative taxes, because the tax rate applied to the bank transaction tax, of 2.81%, will raise more revenue (27% of GDP) than the conventional indirect taxes (ICMS, IPI, INSS, ISS) included in the simulation (10.9% of GDP).

One can see that relative price deviation for the bank transaction tax (Single Tax) was 2.38%, whereas, in the conventional model, it was 5.67%. This proves false the statement that cumulative taxes necessarily create greater distortions in relative prices. It should be noted that although in this particular case the result shows that a turnover tax was less distortionary than conventional taxes (mostly VATs), one cannot assert a priori that this always occurs, or that it never occurs. However, we can assert that under the circumstances of Brazil’s economy, this criticism to cumulative taxation did not prove true, as far as its effect on relative prices is concerned.

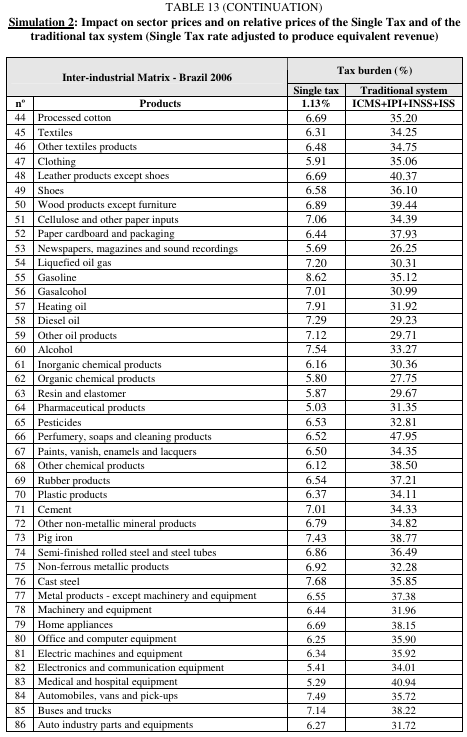

Simulation 2, in TABLE 13, introduces corrections to make the comparison more rigorous. The bank transaction tax rate was reduced to 1.13%, in order to force the revenue raised to be equal to that raised by the conventional taxes included in the simulation (10.9% of GDP). The conventional taxes, as in the previous simulation, are the ICMS, IPI, and ISS, and the employer contributions to social security (INSS). The effect of reducing the bank transaction tax rate from 2.81% to 1.13% caused the relative price deviations to drop from 2.38% to 1.13%, whereas the conventional model’s deviation remained at 5.67%. Deviations in relative prices caused by application of a cumulative tax were less than half the deviations observed in the conventional model, thus proving that the assertions to the contrary, made a priori, are erroneous.

Another interesting variation in the simulations addresses the oft-remembered alternative of eliminating the cumulative social contributions (the CPMF, a bank transactions tax, the Cofins, the PIS and the ISS, which are both corporate gross sales contributions), while maintaining intact all other components of the current Brazilian tax model, including tax revenue. The results can be seen in TABLE 14.

TABLE 12

TABLE 14

The explicit introduction of tax evasion into the simulation model, and its impact on distortions in relative prices, is another interesting topic for future research. The hypothesis assumed in this text is that tax evasion introduces strong elements of instability, volatility, and randomness in relative prices. Simulation 4, in TABLE 15, applies the same parameters as in Simulation 1, but introduces tax evasion into the model.

To this end, the same tax rates used in Simulation 1 were used again, but adjusted for estimates of the weight of the formal sector on the total Value of Production for each sector, as calculated by the BNDES. In other words, we estimate effective tax rates on the formal economy by adjusting the statutory rates to the proportion of informality in each respective sector.

For example, whereas in the sugar industry 100% of the sector is formal, in agriculture 93.1% is not a part of the formal economy. Applying corresponding information for the 110 products used in the simulations, we made equivalent adjustments to each sector’s tax rates, except for the rate of the bank transaction tax (Single Tax) because it is evasion-free even for those economic agents operating in the informal economy. The expectation is that the deviation of relative prices in the Single Tax model will remain constant, because the rate had not changed. But we expect, for the reasons mentioned above, that deviations in relative prices in the conventional model would be higher than the 5.67% found in Simulation 1.

The tax adjustment was done as follows. To the extent that we admit that evasion exists, stimulated by the high rates of conventional taxes, the drop in effective rates will imply a loss of revenue. To correct this, nominal rates of conventional taxes are raised by a proportion derived from the ratio of the sum of nominal rates to the sum of effective rates. The expectation is that in making this correction the higher nominal rates will offset the effects of evasion on tax revenue.

This is, in fact, what happens. The more tax evasion increases, the more the government increases nominal tax rates to offset the loss of revenue. This means that although rates and tax incidence patterns are altered, revenue is kept constant by raising statutory tax rates. In other words, this mechanism makes good taxpayers pay for bad ones.

After such adjustments were made, our hypothesis was confirmed by the simulation. Tax evasion had a strong distortionary effect on relative prices. The dispersion index jumped from 5.67% in simulation 1 (which assumed no tax evasion) to 7.72% in simulation 4, which incorporated tax evasion in the model.

These results strongly suggest the inadequacy of the peremptory and unconditional assertions, made by several scholars and critics of cumulativeness, concerning the distortionary effects of turnover taxes on relative prices, as compared to value-added taxes.

With these observations we hope to be marching ahead in understanding the last pending issue in the Single Tax controversy: that one cannot state a priori whether cumulative or value-added taxes introduce greater distortions in relative prices in the economy. But we can state unequivocally that in the empirical case of the Brazilian economy, bank transaction taxes such as the CPMF are less distortionary than the conventional tax structure made up mostly of value-added taxes.

3

TAXATION IN BRAZIL

INTRODUCTION

A first-time analyst of the literature on tax reform in Brazil would come to a curious conclusion: that the bulk of the controversy surrounding the subject, which dates back to the mid-1990s, focuses almost exclusively on doing away with cascading, or turnover taxes.

In fact, in August 2001, representatives of Brazil’s major business associations published a manifesto demanding an urgent tax reform.122 A close look at the document, however, shows that the true goal of business leaders was neither to discuss the tax issue as a whole – its malfunction and dysfunction – nor to seek comprehensive and definitive solutions to the problem. Rather, it was a severe criticism of cumulativeness present in some of the taxes in use in the country. Those entrepreneurial groups convinced important public opinion leaders that the top priority in tax reform should be nothing more that the elimination of turnover, cascading taxes.

One indicator of their mistake can be gauged in the results of a survey taken by

the National Confederation of Industry, in which 88% of business leaders surveyed pointed to Brazil’s excessive tax burden as the least desirable feature of the current tax system, and not to the presence of turnover taxes. Thus, it is surprising that business leaders have aimed their anger at cumulativeness, instead of arguing for a reduced tax burden and for lower tax rates.

The manifesto contained no demands for fighting tax evasion and corruption. Nor did it call for actions to decrease the high compliance costs related to accessory tax obligations imposed on taxpayers. It did not even complain about bureaucracy or about the inequities of Brazil’s current tax system. The manifesto complained almost exclusively of cumulativeness, despite the fact that what truly suffocates competitiveness in Brazil is not the manner in which taxes are collected (cumulatively or on value-added), but rather the disproportionate weight of Brazil’s tax burden, in excess of 34.8% of GDP in 2007. They were discussing form, and forgot the essence of their problem.

No heed was given to basic problems, such those raised by Everardo Maciel, former Secretary of Federal Revenue who foresaw that “without a doubt, the speed and depth of changes facing the world will affect (or even exhaust) the tax models in use today. Which taxes, then, will continue to exist, or which new ones will be created, are still questions that have no answer.”

Tax evasion, not the CPMF, is the tumor that must be rooted out from the national tax system, and no other system, apart from the bank transaction tax, can do just that. As a matter of fact, the CPMF and bank transaction taxes are not problems in Brazil’s tax system; rather, as assumed by the Federal Revenue Service,” Brazil can prove that the use of bank transaction taxes…can be the solution for taxation in an increasingly globalized and electronically dependent world”.

This text discusses Brazil’s tax system, including its cumulativeness. We demonstrate that a priori rejection of cumulative taxes is the result of prejudice and of poorly digested theoretical concepts. We will also show that it is important to overcome this erroneous and incomplete interpretation of Brazilian tax problems. This is the first step to begin building a more efficient tax model, capable of being more equitable, less costly, and more consentaneous with Brazilian economic and social structures. Such tax model, as will be demonstrated, is the Single Tax system.

BRAZIL NEEDS A NEW TAX SYSTEM

Brazilian society shows signs of deep dissatisfaction with its tax system . It is one of the most complexes in the world, having reached an advanced stage of deterioration, irrationality, inefficiency, and inequity.

In mid-2001, Brazil’s tax legislation consisted of 55,767 articles, 33,374 paragraphs, 23,497 sub-paragraphs, and 9,956 headings. This tax law miscellany is housed in 18,589 pages of texts, decrees, codes, and notices. These figures, however, need to be updated each day. Every year nearly 300 new laws are drafted on the subject – roughly 1.23 alterations per business day.

In less than three years, between May 1995 and December 1998, legislation related to two federal taxes (the Income Tax (IR) and the Industrialized Products Tax (IPI)), one state tax (Circulation Tax on Goods and Services (ICMS)), and two Social Contributions (Social Integration Program (PIS) and Social Security Contribution (Cofins)) increased in the following manner:

• On the IR: 24 laws, 76 provisional measures, 14 decrees, 46 notices, and 149 rulings;

• On the IPI: 8 laws, 41 provisional measures, 20 decrees, 67 notices, and 87 rulings;

• On the ICMS: 24 laws, 165 notices, 314 resolutions and conventions;

• On the PIS: 1 Constitutional Amendment, 7 laws, 122 provisional measures, 1 decree, 3 resolutions, 8 rulings, 3 notices, 1 court order, and 1 legal opinion;

• On the Cofins: 2 supplemental laws, 3 laws, 30 provisional measures, 1 decree, 1 notice, 1 court order, and 1 ruling.

A recent study done by the Instituto Brasileiro de Planejamento Tributário (Brazilian Institute for Tax Planning) estimated that between October 1988, when the new Brazilian Constitution was promulgated, and October 2008, over 240,000 pieces of tax regulation and legislative acts were issued, which amounts to 34 pieces of legislation issued each day since 1988, including week ends and holidays.

Such complexity, typical of declaratory taxes is not unique to Brazil. In the United States heated debate has been waging over changes in that country’s main source of revenue, the income tax. Current US federal tax law is contained in no less than 45,662 pages, a number which has grown by 74% since 1984. Between 1990 and 2000, the number of tax forms increased by 23%%. The eight largest taxconsulting firms experienced sales increases of 112% between 1996 and 2001. The American “tax industry” currently employs over 1 million people, more than the entire automotive industry. US taxpayers spend US$ 183 billion annually in compliance costs alone (filling out forms and returns).

In Brazil, the excessive number of taxes has directly contributed to record increases in revenue, year after year. TABLE 16 shows the growth of the tax burden in Brazil.

Some argue that the tax burden, as a percentage of Brazil’s GDP, could increase, considering that in several developed countries they are still higher. However, such an opinion is nonsensical if taken as an isolated statement. A country’s tax burden can only be appraised considering, comparatively, its per capita income levels and its stage of development.

TABLE 16

TABLE 17 shows the tax burden in selected countries. Brazil carries a tax burden that is incompatible with the per capita income level of the population. All countries bearing a tax burden near or higher than 30% of GDP have per capita annual income of US$ 40,000 or more. It is worth noting that countries with per capita income of less than US$ 10,000 per year have tax burdens of less than 25% of GDP. Brazil (and Uruguay in this sample of countries) is a clear example of extravagant over taxation.

Brazilian consumers bear high indirect taxes built into prices of products and services. According to ABIA [Brazilian Food Industry Association], taxes account for up to 34.7% of the final price of food. Internationally, the average is 7%. TABLE 18 illustrates the abusive taxation of consumer goods in Brazil, which results in low purchasing power of wages and in loss of competitiveness of Brazilian products in foreign markets. Most taxes on domestic production are not exonerated at the time of export, making exported goods and services carry heavy tax loads built into their prices (tax export).

In order to defend themselves from such an abusive tax burden, taxpayers practice evasion as a dodge necessary for survival. Tax avoidance has become a behavioral rule for Brazilian taxpayers, to the point of being called a “national religion”.

TABLE 17

In 1999, the Secretary of the Federal Revenue, Everardo Maciel, testified before the CPI [Parliamentary Investigative Commission] on the Financial System. His statement caused a strong impact on public opinion. The country was officially informed that large-scale tax evasion, tax avoidance, and other forms of tax hiding were common practices. According to his testimony, R$ 825 billion, almost one year of Brazil’s GDP, slipped through the fingers of the Federal Revenue without a cent of it being collected, except for a small amount of revenue collected by the CPMF (a turnover bank transactions contribution). He stated, furthermore, that half of Brazil’s 530 largest corporations had not been paying income tax, and 42% of the 66 largest banks had accomplished the same feat.

Tax evasion is a deadly tumor to be extirpated from the nation’s tax system. The prevalence of this anomaly is responsible for deep tax injustices. According to the proceedings of the CPI [Parliamentary Investigative Commission] on Tax Evasion, “tax evasion is entrenched in the population, in taxpayers, due to an educational and moral problem.”

The Federal Revenue has been cross-referencing bank transaction data with filed income tax returns. The data reveal that billions of reais circulate free from the reach of the income tax.

TABLE 18

In 1999, cross-referenced data uncovered taxpayers who claimed to be exempt

or economically inactive, and firms registered under the Simple [simplified tax procedures for micro and small firms], but whose bank transactions, surprisingly, amounted to approximately half of Brazil’s GDP, as shown in TABLE 19. It is worth noting that 559,161 individuals and firms transacted a total amount of R$ 116.9 billion, a monthly average of R$ 9.74 billion, while “claiming” to be exempt from income tax (of those, 424,435 individuals and firms that transacted R$ 77,736 billion were suspected of evasion, as seen in TABLE 19).

The data also revealed that 254 individuals and firms transacted the overwhelming amount of R$ 164.1 billion without paying income tax. On average, each one transacted R$ 54 million per month, but claimed to be exempt, inactive, registered under the Simple [simplified method of tax calculation used for small and micro firms], or were outright omissive. The analysis concluded that in 1999, 512,117 individuals and companies transacted R$ 465.5 billion, or R$ 38.8 billion per month, without reporting such payments to tax authorities. Implicitly, such transactions represented evaded earnings estimated at R$ 339.2 billion, or R$ 28.3 billion per month. In other words, transactions equivalent to approximately 32% of GDP evaded Brazil’s income tax.

Tax avoidance makes the current pattern of tax incidence on production so chaotic, unpredictable, and devastating that it can bankrupt an efficient taxpaying company. On the other hand, it can enable an inefficient tax-evading producer to survive, by looting its competitors in the marketplace.

TABLE 19

According to surveys, 40% of Brazil’s income are not reported to tax authorities due to evasion or to escaping into the underground economy. This figure implies that the current tax burden of 38% of GDP is borne by 60% of potential taxpayers; in other words, those that pay bear a tax burden of almost 65% of their taxable income, while evaders contribute little to society, or much less than they should.

Furthermore, tax evasion has an inevitable consequence: corruption. In Brazil, tax avoidance and evasion are accepted as normal facts of life, and are often praised as signs of courage and boldness in market behavior. Collusion between tax evaders and corrupt tax officials has been a cause of severe deterioration of ethical and moral standards of Brazilian society.

But it is on labor income that Brazilian tax burden sets a dreary record.

The combination of widespread tax evasion and the need for increased public revenue has turned payroll employees into one of the most heavily burdened subjects of taxation. Because of greater difficulties in practicing evasion or avoidance, regularly hired payroll employees are easy prey to escalating taxation. Additionally, the government has overburdened employers with extremely high fiscal and social security obligations.

Labor income in Brazil, which accounts for only 26.8% of domestic income, bears the burden – directly and indirectly – of approximately 53.5% of the country’s tax revenue. This provides clear indication that, in order to compensate for revenue lost to evasion, the government transfers the tax burden to those for whom tax evasion is all but impossible, namely, payroll employees. Data from both the US Internal Revenue Service and the Federal Revenue show that in the United States the individual income tax rate increases from 15% to 19% as taxable wage income reaches R$ 119,200 annually. In Brazil, the same rate increase is triggered when taxable income reaches R$ 15,200 per year.

This fact contributes significantly to current high unemployment rates. Furthermore, the high cost of hiring and maintaining payroll employees is one of the key causes of the growth of the informal economy. Half of Brazil’s workers are not formal payroll employees.